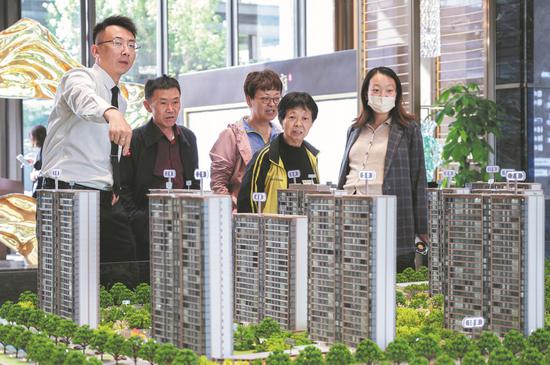

Potential homebuyers look at a property model in Taiyuan, Shanxi province. (WEI LIANG/CHINA NEWS SERVICE) China still has policy room to further stabilize the property market by boosting demand and optimizing supply without excessive stimulus, thereby further reining in the industry's downturn, experts said. However, the country needs to ramp up efforts to restructure both the property industry and the broader economy, to ensure high-quality development, they said. "We believe that there's still a high possibility of more supportive policies aimed at stimulating sales in the short run, which will help constrain the decline in property sales," said Wang Xingping, senior analyst of the corporates department at rating agency Fitch Bohua. "The purchase restrictions in some districts of tier-1 cities are expected to be eased. However, the complete cancellation of such curbs in core areas of tier-1 cities may not happen in the short run as regulators aim to stabilize the property market while avoiding overheating again." The Chinese authorities announced a new round of policy easing measures on Friday. They rolled out a series of significant supportive policies nationwide, including further reduction in the down payment ratio to a historic low, lifting of the lower limit for personal mortgage loan interest rates, lowering of the provident fund loan interest rates and establishment of the special-purpose re-lending program for affordable housing. The new policies' aim is to boost homebuyer sentiment and ease developer liquidity stress. Robin Xing, chief China economist at Morgan Stanley, forecast that housing support measures may continue to evolve in the coming quarters. "We see more urgency to execute home completion with better utilization of policy banking tools," Xing said. With further home purchase relaxations anticipated, the announced policies should facilitate faster market clearing, support liquidity among developers, restore homebuyer confidence and improve housing investment, albeit with a lag, he said. Amid a challenging period of sluggish demand and liquidity stress, the combined revenues of Chinese mainland developers listed in the A-share and Hong Kong markets reached 4.1 trillion yuan ($570 billion) in 2023, up 3.4 percent year-on-year, according to a report by Chinese-language newspaper Securities Times. Half of the developers realized revenue growth last year, having seen their revenue plunge in 2022. Most importantly, the leverage ratios of leading real estate companies have continued to decline, resulting in a more optimized assetliability structure. For top-tier real estate enterprises with annual sales exceeding 1 trillion yuan in 2023, the median asset-liability ratio, after adjusting for advances from buyers, stood at 62.63 percent last year. That represented a 3.4 percentage point decrease from 2022 to a nine-year low, indicating a substantial reduction in leverage. Lu Ting, chief China economist at Nomura, a Japanese international financial institution, said the property industry remains key to cementing the momentum of the Chinese economy given its great significance to the entire economy. While China needs to develop public housing in the long term as a focus of a new development model for the real estate industry, it is still critical now to revive the existing market-oriented housing supply system by ensuring pre-sold housing delivery, Lu said. Wang Qing, chief macroeconomic analyst at Golden Credit Rating International, said that for long-term stability in real estate and broader economic growth, a balanced approach between affordable and commercial housing is key — and restrictions on housing purchases and mortgage should be phased out gradually. "The government must increase affordable housing supply to meet needs from low-income groups, which supports urbanization and economic growth," he said. "The industry must abandon the 'three highs' model — high leverage, high turnover and high debt — to reduce developer credit risks. Implementing a capital-gains tax on property sales can also deter speculation and prevent excessive price increases." Chang Haizhong, executive director of corporates at Fitch Bohua, warned that if economic development overly relies on the real estate industry, the economy would be easily impacted by cyclical fluctuations in the housing market. "In order to ensure stable economic growth, we need to step up efforts in economic structural transformation, and cultivate more emerging industries with huge market potential, like new energy vehicles, photovoltaics, wind power, lithium-ion batteries and the silver economy," Chang said. |

广告合作(Contact Us)|关于我们|小黑屋|Archiver|加拿大伦敦华人网

GMT-4, 2025-4-5 06:41

Powered by Discuz! X3.5 Licensed

© 2001-2025 Discuz! Team.